Ethereum Price Prediction 2025-2040: Technical Momentum and Fundamental Strength Signal Major Upside Potential

#ETH

- Technical Momentum: Strong MACD bullish divergence despite trading below 20-day MA suggests underlying strength

- Supply Dynamics: Plummeting exchange reserves and institutional staking indicate potential supply shock

- Institutional Adoption: Fidelity's RWA initiatives and massive stablecoin inflows signal growing mainstream embrace

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Divergence Despite Short-Term Pressure

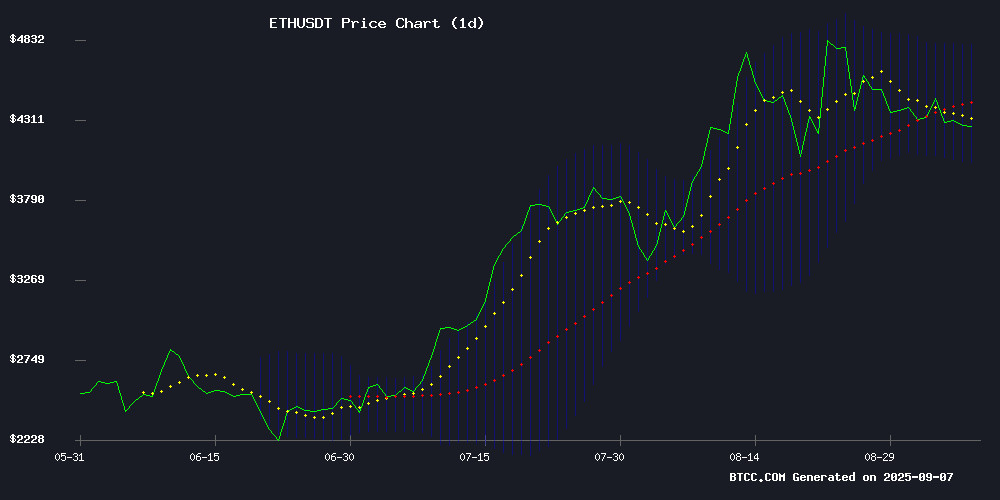

ETH is currently trading at $4,275.39, sitting below its 20-day moving average of $4,419.66, indicating some near-term bearish pressure. However, the MACD reading of 164.37 with a signal line at 13.66 shows strong bullish momentum divergence. The Bollinger Bands position with upper band at $4,804.20 and lower band at $4,035.11 suggests ETH is trading in the lower range, potentially indicating a buying opportunity. According to BTCC financial analyst William, 'The technical setup suggests consolidation with bullish potential. A break above the 20-day MA could trigger momentum toward the upper Bollinger Band.'

Market Sentiment: Institutional Adoption and Supply Dynamics Support Bullish Outlook

Recent developments paint a fundamentally strong picture for Ethereum. Fidelity's launch of a tokenized treasury fund on ethereum signals growing institutional embrace of real-world assets. Despite record weekly outflows from US Ethereum ETFs totaling $787 million, the underlying fundamentals remain robust. Ethereum holdings on centralized exchanges are plummeting, suggesting a potential supply shock. Record stablecoin inflows reaching $150 billion and SharpLink Gaming's decision to stake $3.6 billion in Ethereum treasury further support bullish momentum. BTCC financial analyst William notes, 'The combination of institutional adoption, decreasing exchange reserves, and massive stablecoin inflows creates a perfect storm for price appreciation despite short-term ETF outflow concerns.'

Factors Influencing ETH's Price

Ethereum Whales Shift to Self-Custody as Exchange Reserves Dwindle

Ethereum's exchange reserves are undergoing a significant contraction, with Binance and Coinbase collectively shedding over 1.6 million ETH in two weeks. This exodus signals a strategic pivot toward long-term holding and self-custody among major investors.

The supply squeeze coincides with ETH's steady climb toward $4,300, creating textbook conditions for scarcity-driven price appreciation. Derivatives markets echo this bullish sentiment, with Binance reporting a 2.47 Long/Short Ratio as 71.2% of traders maintain long positions.

Funding Rates hover at 0.0082%—positive yet restrained compared to previous cycles. This tempered leverage suggests the rally may have room to run before overheating. The market appears to be pricing in Ethereum's structural advantages as institutional adoption grows.

Fidelity Launches Tokenized Treasury Fund on Ethereum, Signaling Institutional Embrace of RWAs

Fidelity Investments has discreetly introduced a tokenized U.S. Treasury product on the ethereum blockchain, marking another milestone in traditional finance's adoption of blockchain technology. The Fidelity Digital Interest Token (FDIT) represents shares in the firm's $200 million Fidelity Treasury Digital Fund, which holds U.S. government securities and cash equivalents.

The fund's rapid asset growth to $200 million since its August launch demonstrates institutional demand for blockchain-based yield products. With Bank of New York Mellon serving as custodian and Fidelity charging a 0.20% management fee, the offering follows the asset manager's earlier SEC filing for an on-chain share class.

This MOVE accelerates the real-world asset tokenization trend gaining momentum across Wall Street. Major players like BlackRock are similarly exploring blockchain infrastructure to streamline settlement, reduce costs, and create new market efficiencies.

US Ethereum ETFs See Record $787M Weekly Outflow Amid Market Uncertainty

US-based Ethereum exchange-traded funds (ETFs) faced their worst week since launch, with a staggering $787.74 million in net outflows. The bleeding peaked on September 5, when single-day withdrawals exceeded $446 million—a clear reflection of eroding investor confidence in crypto-linked products.

BlackRock's iShares Ethereum Trust (ETHA) bore the brunt, hemorrhaging $309.88 million. Grayscale's offerings (ETHE and ETH) followed with $51.7 million and $32.62 million outflows respectively, while Fidelity's FETH shed $37.7 million. Only 21Shares' ETF avoided the exodus.

The mass retreat mirrors ETH's stagnant price action, signaling broader market indecision. After a strong Q3, these investment vehicles now face their first true stress test as institutional players appear to be hitting pause.

ARK Invest Expands Crypto Holdings with $23.5M BitMine and Bullish Purchases

ARK Invest has bolstered its cryptocurrency portfolio with a $23.5 million investment in BitMine (BMNR) and Bullish (BLSH) stocks. The firm acquired 387,000 BMNR shares worth $16 million and 144,000 BLSH shares valued at $7.5 million, distributed across its ARKK, ARKW, and ARKF ETFs.

This move deepens ARK's commitment to BitMine, following earlier purchases totaling $206.6 million in July and August. BitMine continues to aggressively accumulate Ethereum, recently adding 80,000 ETH ($358 million) to its holdings. The company now controls 1.86 million ETH ($8.02 billion), representing 1.547% of circulating supply.

Ethereum Holdings On Centralized Exchanges Plummet — Supply Shock Imminent?

Ethereum's price volatility between $4,260 and $4,490 reflects deeper market dynamics beyond mere speculation. Centralized exchanges, particularly Binance and Coinbase, have seen significant outflows of ETH, with Binance losing 700,000 ETH in under two weeks and Coinbase shedding 900,000 ETH during the same period. Over two months, exchanges collectively bled 2.6 million ETH.

The inverse correlation between exchange reserves and ETH's market price suggests tightening supply. Such movements often precede bullish momentum, as reduced liquidity on exchanges can amplify upward price pressure. Market participants are watching for a potential supply shock, where demand outstrips readily available tokens.

Ethereum Price Prediction: ETH Shows Strength Amid Institutional Interest and Whale Accumulation

Ethereum's price action dominates market discussions as institutional ETF inflows and significant whale activity fuel bullish sentiment. Analysts highlight key support levels at $3,360 and $3,960, with near-term targets ranging between $4,374 and $5,255. Longer-term projections are even more optimistic, with Finder forecasting $6,100 by 2025 and Wallet Investor predicting a climb past $7,000 within five years.

Meanwhile, Remittix emerges as a dark horse in the PayFi sector, raising $24.1 million and securing listings on BitMart and LBank. Its upcoming Beta Wallet launch in Q3 adds momentum to its growth narrative, drawing attention away from Ethereum's spotlight.

Record Stablecoin Inflow Puts $5,000 ETH Price Target in Play

Ethereum is attracting unprecedented liquidity, with $6.7 billion in stablecoin inflows over the past week alone. The network now holds over $145 billion in stablecoins, cementing its dominance as the primary settlement LAYER for dollar-backed tokens in crypto. Such inflows often serve as dry powder for future rotations into ETH or other assets when market sentiment shifts.

Institutional demand is concurrently rising, with Ether ETFs like BlackRock's spot product seeing steady growth in assets under management. These regulated vehicles are increasingly becoming gateways for professional investors seeking exposure to Ethereum.

Macroeconomic conditions appear favorable, with a slowing U.S. economy and anticipated Fed rate cuts later this year. Looser financial conditions historically benefit crypto assets, while progress on stablecoin legislation in Washington adds legitimacy to Ethereum's role in the tokenized dollar ecosystem.

Layer-2 networks continue expanding Ethereum's throughput and reducing transaction costs, further strengthening the network's fundamentals as it approaches the $5,000 price target.

Ethereum's Rollercoaster Ride: A $10,000 Investment Five Years Ago Today

Ethereum (ETH) remains a cornerstone of the cryptocurrency market, despite the cooling frenzy of new token launches that characterized the late 2010s. Since the start of the year, ETH has surged over 32%, reigniting investor interest.

A $10,000 investment in Ethereum five years ago WOULD have weathered extreme volatility. The crypto skyrocketed 408% in 2021 amid the decentralized finance boom, only to plummet 67% in 2022 following the FTX collapse and macroeconomic headwinds.

Recent price action shows Ethereum's sensitivity to macroeconomic cues. The token rallied last month after Federal Reserve Chair Jerome Powell hinted at potential policy shifts, underscoring its growing correlation with traditional markets.

Ethereum Price Outlook: $6K Target in Focus Amid Market Volatility

Ethereum's path to $6,000 remains plausible despite spot market weakness, with analysts highlighting key technical levels and structural demand drivers. The $4,450-$4,500 resistance zone now serves as a critical pivot—a decisive break could trigger momentum toward $4,729 and beyond.

On-chain data reveals sustained accumulation by whales and ETF-related buying pressure, reinforcing the bullish thesis. Chart patterns suggest a potential Wyckoff accumulation phase, typically preceding significant upside breaks when confirmed.

Fibonacci extensions point to medium-term targets between $6,000-$6,750, contingent on holding the $4,400 support level. Meanwhile, MAGACOIN FINANCE emerges as a speculative counterpoint, drawing attention from risk-tolerant traders.

Ethereum Stablecoins Surge to $150B, Signaling Bullish Momentum for ETH

Ethereum's stablecoin supply has reached a historic $150 billion, underscoring growing confidence in the network's utility and stability. This milestone coincides with ETH's price hovering above the $4.3K support level, suggesting a consolidation phase before potential upward movement.

Market structure remains bullish, with $5K emerging as the next critical resistance. Institutional interest appears to be building, evidenced by rising open interest and the network's robust validator count of 1.1 million. These factors could catalyze the next leg of ETH's rally.

Retail traders currently dominate price action, but the combination of record stablecoin liquidity and Ethereum's security fundamentals may soon attract larger players. The network's supply dynamics and on-chain metrics continue to favor accumulation, setting the stage for a potential breakout.

SharpLink Gaming to Stake $3.6 Billion Ethereum Treasury on Linea Network

SharpLink Gaming (NASDAQ: SBET) is making a strategic pivot toward Ethereum's Layer-2 infrastructure, announcing plans to stake portions of its $3.6 billion ETH treasury on the Linea network ahead of its September 10 mainnet launch. The move positions the gaming company as a governance partner in the Linea Consortium, which controls 75% of LINEA token distribution.

Ethereum's recent rally—nearly 200% since April—has drawn institutional interest, with whales accumulating 5.54 million ETH and August inflows hitting $3.87 billion. SharpLink's approach diverges from passive corporate holdings, actively pursuing yield through staking while leveraging Linea's cost-efficient transactions for operational gains.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Ethereum appears positioned for significant long-term growth. The combination of strong institutional adoption, decreasing exchange reserves, and robust technical momentum suggests substantial upside potential over the coming decades.

| Year | Price Prediction (USD) | Key Drivers |

|---|---|---|

| 2025 | $6,000 - $8,000 | ETF maturation, institutional RWA adoption, supply shock effects |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, scalability solutions, global regulatory clarity |

| 2035 | $25,000 - $40,000 | Web3 infrastructure dominance, tokenization of major assets |

| 2040 | $50,000 - $80,000 | Global reserve currency status, complete financial system integration |

BTCC financial analyst William emphasizes that 'While short-term volatility is expected, the convergence of technical strength and fundamental adoption creates a compelling case for Ethereum's multi-decade growth story. The current price action represents an attractive entry point for long-term investors.'